Healthcare

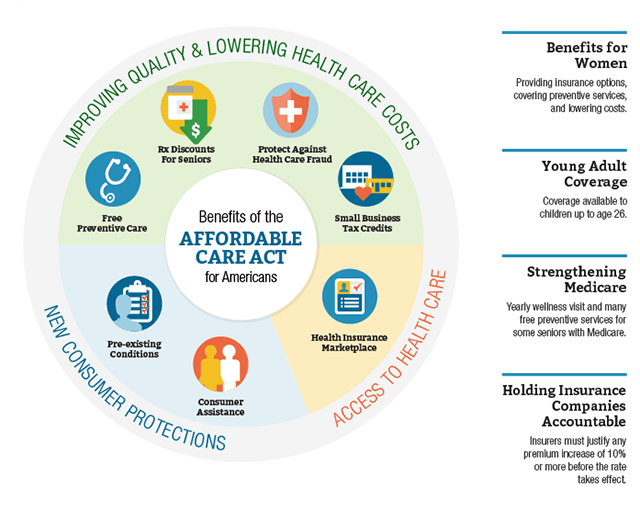

The Affordable Care Act also known as ACA, created significant changes in how Americans choose and pay for their healthcare. But how do all these changes relate to you and your taxes?

| Important ACA IRS Links

Individual Shared Responsibility Provision ACA Tax Provisions for Small Businesses ACA Tax Provisions for Large Businesses |

How Can I Get Health Coverage Outside of Open Enrollment?

After Open Enrollment ends, you can enroll through the Marketplace only if you qualify for a Special Enrollment Period due to changes to your household, income, and other major life events.

Before you apply with a Special Enrollment Period, there are a few things you should know about SEPs…

Any plan you enroll in with a Special Enrollment Period ends on December 31.

This is true no matter what month coverage started.

To qualify for a Special Enrollment Period, you must have a qualifying life event.

Examples of qualifying life events include:

- Marriage or divorce

- Having a baby, adopting a child, or placing a child for adoption or foster care

- Moving your residence, gaining citizenship, leaving incarceration

- Losing other health coverage due to losing job-based coverage, the end of an individual policy plan year in 2014, COBRA expiration, aging off a parent’s plan, losing eligibility for Medicaid or CHIP, and similar circumstances.

Important: Voluntarily ending coverage doesn’t qualify you for a Special Enrollment Period. Neither does losing coverage that doesn’t qualify as minimum essential coverage.

For people already enrolled in Marketplace coverage:

- Having a change in income or household status that affects eligibility for premium tax credits or cost-sharing reductions

- Gaining status as member of an Indian tribe.

- Members of federally recognized Indian tribes can sign up for or change plans once per month throughout the year.

You may also qualify for a Special Enrollment Period if you had a complex situation related to applying for Marketplace coverage.See plans and price estimates before you apply with an SEP. You can preview plans and estimated prices that apply only to coverage you can get with an SEP.